Have you ever wondered if it’s possible to obtain a car loan while going through the rough financial patch of bankruptcy? The notion might seem counterintuitive at first glance. Bankruptcy often brings to mind images of financial hardship, credit score setbacks, and limited options. However, the world of finance is not always black and white.

Surprisingly, bankruptcy car loans exist as a potential solution for those aiming to rebuild their credit and regain their mobility. In this article, we delve into the intricacies of bankruptcy car loans and shed light on how they can be a viable option for individuals looking to reestablish their financial footing.

The Enigma of Bankruptcy Car Loans

At the heart of the bankruptcy car loan concept lies a paradox: how can someone facing financial distress be considered eligible for a loan? The answer lies in the understanding that a bankruptcy car loan functions as a tool for recovery, not just an ordinary loan. It’s structured in a way that mitigates risks for both the lender and the borrower.

Mitigating Risk through Collateral

Collateral plays a pivotal role in bankruptcy car loans. In most cases, the vehicle being financed serves as collateral, providing the lender with a sense of security. Should the borrower default on payments, the lender can repossess the vehicle to recoup their losses. This arrangement offers lenders a safety net that encourages them to extend loans to individuals with less-than-perfect credit.

Interest Rates

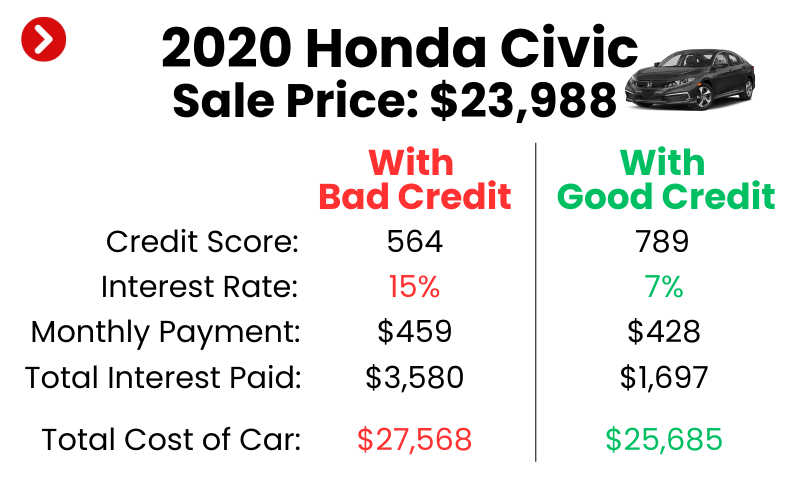

Interest rates often become the focal point of discussions surrounding bankruptcy car loans. It’s no secret that these loans typically carry higher interest rates compared to loans obtained by individuals with stronger credit histories.

This premium is the lender’s way of offsetting the increased risk associated with lending to someone who has recently undergone bankruptcy. Despite the higher rates, these loans can still be valuable for rebuilding credit and regaining financial stability.

To learn more about what is a good interest rate for a car loan, click here.

Terms and Conditions

Bankruptcy car loans come with specific terms and conditions that cater to the borrower’s unique situation. These terms might include a shorter loan term, ensuring that the borrower can repay the loan more quickly and avoid prolonged financial commitment.

Additionally, lenders may require a larger down payment, demonstrating the borrower’s commitment to the loan and providing further security for the lender.

The Crucial Role of Timely Payments

Timely payments are the linchpin of success when it comes to bankruptcy car loans. Consistently meeting payment deadlines not only helps rebuild the borrower’s credit score but also establishes a pattern of responsible financial behavior.

Demonstrating reliability and stability can gradually improve the borrower’s overall creditworthiness, potentially leading to better financial opportunities in the future.

A Second Chance on the Horizon

In a financial landscape where bankruptcy often seems like an insurmountable obstacle, bankruptcy car loans offer a glimmer of hope. They are not just loans; they are stepping stones to financial recovery.

By using the vehicle as collateral and navigating the intricacies of higher interest rates, shorter terms, and timely payments, individuals can rebuild their credit scores and regain control of their finances. Bankruptcy car loans remind us that even in the face of adversity, there are paths to redemption and opportunities for a fresh start on the road to financial stability.