Are you concerned about securing a car loan with a 600 credit score? A credit score in this range can present challenges when seeking financing, but it’s not an insurmountable obstacle. In this article, we’ll explore the nuances of obtaining car loans with a 600 credit score and how to improve your chances of approval.

The Impact of a 600 Credit Score

A credit score of 600 falls into the “fair” credit category. While it’s not considered excellent, it’s also not the lowest score possible. Lenders may view a 600 credit score as a moderate level of risk, which can affect the terms of your car loan.

Finding Lenders for 600 Credit Score Car Loans

Although traditional banks and lenders may be less inclined to approve loans for individuals with fair credit, there are still options available:

Subprime Lenders: These lenders specialize in providing financing to individuals with credit scores below 660, making them more willing to work with a 600 credit score. We are one of those lenders! Click here to learn more.

Credit Unions: Some credit unions may offer more lenient terms to their members, including those with fair credit.

Online Lenders: Online lenders often have more flexible criteria and may be willing to approve car loans for borrowers with a 600 credit score.

Expectations for 600 Credit Score Car Loans

When seeking a car loan with a 600 credit score, here’s what you can expect:

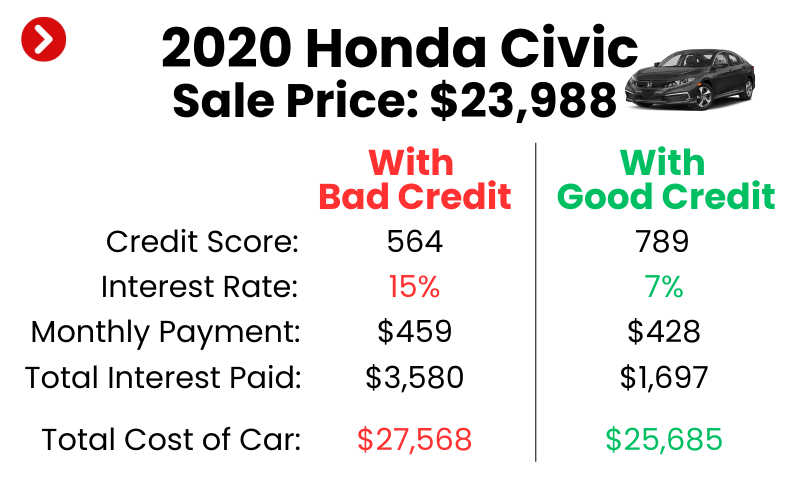

Higher Interest Rates: Lenders may offer loans with higher interest rates to compensate for the perceived risk associated with fair credit.

Smaller Loan Amounts: You may qualify for a smaller loan amount compared to borrowers with higher credit scores.

Shorter Loan Terms: Lenders may prefer shorter loan terms to mitigate risk.

Improving Your Chances of Approval

To increase your chances of approval and secure more favorable loan terms:

Review Your Credit Report: Check your credit report for errors and dispute any inaccuracies.

Strengthen Your Credit: Work on improving your credit score by paying down debts and making payments on time.

Increase Your Down Payment: A larger down payment can offset a lower credit score and improve your loan terms.

Shop Around: Don’t settle for the first loan offer you receive. Shop around and compare offers from multiple lenders to find the most favorable terms.

Consider a Co-Signer: If possible, ask a trusted friend or family member with good credit to co-sign the loan.

Responsible Borrowing

Lastly, it’s crucial to borrow responsibly. Make sure the monthly payments fit comfortably within your budget to avoid financial strain. Timely payments on your car loan can also help improve your credit score over time.

Your Journey Starts Here

While securing a car loan with a 600 credit score may require extra effort and may come with less favorable terms, it’s entirely feasible. With patience, financial discipline, and the right lender, you can still make your car ownership dreams a reality and use this opportunity to rebuild your credit for a brighter financial future.