Our Guide to Rebuilding Credit Score

It’s a slow process, but with these tips you can get the process started. Updated for 2023.

Reasons to Start Rebuilding Credit Score

Even though we all know credit score is a very important number, but unless we’re looking for a loan it’s not something we actually think about too often. However, maybe you should be, and hopefully we can give you some good reasons to convince you to start building your credit.

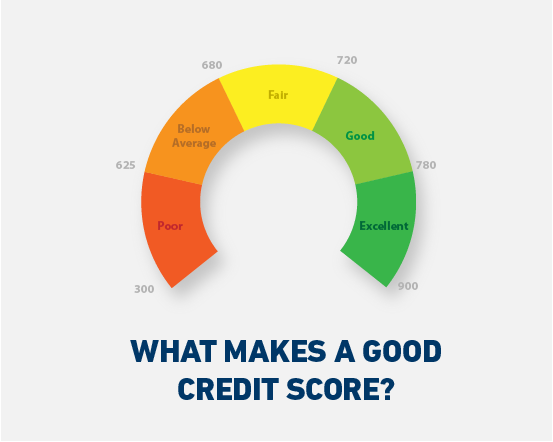

Lower interest rates: The amount of interest you pay on a loan is often the decider between whether or not you take the deal. This is the biggest reason to build credit score; the higher your credit, the less you’ll be paying in interest. This happens because the lender trusts you more with the loan. The lower the interest, the faster you’ll be able to pay off the loan and get out of debt in general.

Higher approval changes: No car loan application is always 100% guaranteed no matter what, but a higher credit score will greatly increase your chances. Loan approval in Brantford is based on the amount of risk the lender sees in you. People with high credit score are seen as less risky because it shows that they have control of their financial situation.

Credit score is also a determining factor when it comes to renting a house or apartment.

Higher limits: We believe that even though having a higher limit isn’t always a good idea, having the option is still better than not. Similarly to loans and rent, a credit limit is also based on risk assessment. The higher your credit score, the more debt you’ll be allowed to take on because the lender has more assurance you’ll pay it back on time.

Better car insurance rates: Many people don’t know that one of many the variables in the calculation on your insurance rate is your credit score. To be honest, it’s unclear what your credit score has to do with your likelihood to crash, but nevertheless this is something to consider; the higher your credit score, the better insurance price you’ll get.

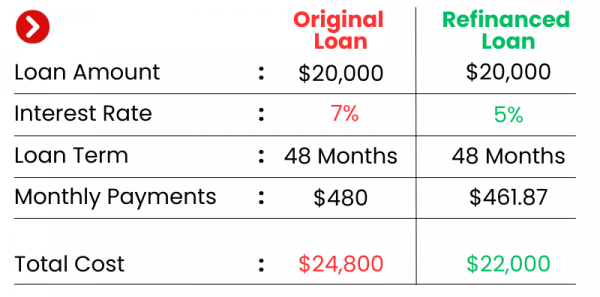

What is Good Credit Score?

Here are the credit score ranges:

- 300-625 : Poor

- 625-680: Below Average

- 690-720: Fair

- 720-780: Good

- 780-900: Excellent

How to Rebuild Credit Score

Get a Credit Report and Constantly Monitor it

Before you start rebuilding your credit score in Ontario it’s good to know exactly where you’re starting from. Your credit score is calculated from all of the different factors of your credit report, so that’s where you want to start.

Your credit report will give you a detailed list of all of your unpaid debts, active lines of credit, missed payments, every time credit passed through your hands in the last 10 years will be written out, useful information to have.

You can also check for errors, they’re more common than you might expect and can contribute negatively to your credit score. Finding and fixing an error may be a nice head start on the recovery process.

As a Canadian you’re entitled to a free credit report every 6 months and while you’re in the process of rebuilding you want to be checking it as much as you can. Getting a credit report doesn’t affect your credit but it gives you access to all the information and lets you see what affects your rebuilding efforts are having.

How to Check your Credit Report:

Online: The easiest way to check your credit report is online! In Canada, there are 2 credit bureaus that you can get your credit report from: Equifax and TransUnion.

Both bureaus now give credit reports entirely online through their respective websites. All you need to do is enter your information and you’ll receive access to your report.

Delivered: Every 6 months you’re entitled to a free credit report in Brantford delivered to you by mail. There are 2 ways to get it: call either of the credit bureaus listed above where you’ll go through an automated process and are asked questions, or you can go to either of their websites and fill in a form with the same information.

The credit report is free provided you’re in that 6 month window, and you can pay for faster delivery. (Equifax: 1-800-465-7166, TransUnion: 1-800-663-9980)

How to Read your Credit Report:

Once you’ve got your credit report, you might notice that it’s very confusing! Luckily you don’t need to memorize any of the confusion. The report will come with a sheet that tells you what the different condes mean. You can also go to the online guide provided by the government of Canada.

Reasons to Check your Credit Report Regularly:

Stay informed: Even if you aren’t planning on getting a loan anytime soon, credit score is still one of the most important parts of your finances if you want to save money. You never know when you’re credit score is going to be needed for something, so best to stay in the loop.

Your credit report makes it easy to keep track of your active loans or any credit cards you have, as well as the repayment status of them. Most importantly, you get to keep track of your credit score itself.

Catch errors: Without checking a credit report, errors can go unnoticed for a very long time. They are more common than you might think and will never get corrected unless you keep track of them. Some issues are quite minor and not worth losing sleep over, but others can have a significantly negative impact on your credit score.

Make sense of it: As your checking your credit score regularly, you’ll begin to start making sense of it. By tracking your spending between reports, you’ll be able to see how your credit score is adjusting. The better you can understand how credit reports work in Brantford, the more you’ll be able to use them in your favour.

Be ready for loans: By doing regular checks you’ll know exactly what your score is and can keep working to improve it in preparation for your next big loan (like a car!).

Common Credit Report Errors:

Personal information: Includes spelling mistakes in your name/address, typos in your phone number, or outdated information. Errors like this won’t have an effect on your credit score but can cause other administrative issues down the line. Best to fix them just incase!

Accounts you didn’t open: If you see an account on your report that you didn’t open, there are 2 potential reasons. The first is a clerical error; someone with the same name as you opened an account and the teller accidentally put it on your report. The second option is identity theft. Both options could have a serious impact on your credit score.

Reporting errors: These are could be a few things; payments that have been marked incorrectly (missed or late), or incorrect balances and limits. Even though these are just mistakes, they usually have the biggest impact out of any error. they make you look like an unreliable borrower and this will greatly reduce your credit score if not dealt with.

How to Fix Errors on your Credit Report:

Fixing errors on your credit report can be quite tedious at times. First, you need to acquire proof that the error is indeed an error which usually can be done with a bank report or a report from the lender you have an account with.

Then, you’ll need to contact of the credit bureaus. Once you do that, all you can do next is wait until the issue gets resolved. If this does not work, the problem might lie with the creditor instead of the bureau, so you’ll have to contact them instead.

Pay Off Debts

Around 35% of your credit score is calculated via payment history, which means your Ontario credit score really doesn’t like late payments. Any late payments you’ve made are going to leave their mark for the next 10 years but you can start countering them by making sure you don’t miss any more payments. Automating your payments is highly recommended.

Credit is a strange thing because contrary to what you might think having no debt isn’t actually desirable when it comes to your credit score, though having too much isn’t what you want either, you need to strike a fine line with what’s called your “credit utilisation ratio”. This is basically how much credit you have access to versus how much you’re actually using.

You want this number to be less than 30% but greater than 0% in that nice comfortable range for the greatest results.

Have and Use Credit Cards

In combination with the previous point, you really don’t want tons of active credit cards as that will vastly increase your credit utilization, but you want at least one, as long as you can consistently pay it off.

Constantly using and paying off a credit card looks really good on paper as you’re making lots of credit repayments on time and it keeps your credit utilization above zero.

A credit card is the easiest way to start building credit. It’s basically a tiny loan for small purchases.

Other Reasons to use credit cards:

Rewards programs: Almost all credit cards come with some sort of rewards program. Most people ignore these (which the banks are relying on) but if you actually use them you might find it can actually save you a lot of money.

Most credit card rewards programs work like a points system; you gain points every time you make a purchase and you can use those points to redeem certain rewards from movie tickets to flights. It all depends on your bank and type of credit card!

Safety: The great thing about credit cards is that it isn’t actually your money until you pay it back. This means if you ever fall victim to fraud or have your credit card stolen, all you need to do is let the bank know. Aside from that it’s not your problem to deal with because it’s not your money being stolen!

Increase your Credit Limit

This is where you can use the credit utilization ratio we talked about earlier to your advantage. If you increase your credit limit but keep using the same amount of credit (spend the same), then you can trick your credit score into being better than it was before.

Reasons for a Drop in Credit Score

A sudden drop in credit does happen sometimes and it can be pretty scary, especially when you’ve been working hard to improve it. There are always logical explanations for these things though and the best thing to do is figure out why it happened. Here are the usual suspects:

New credit cards: If you recently opened a new credit card, it might have a temporary reduction on your credit score. Whenever you apply for a new credit card, the bank will do a “hard inquiry”, which is when a potential lender accesses your credit score to examine it and make sure you’re a reliable candidate. Hard inquiries reduce credit score! Why? Because the more credit inquiries on your report, the more it appears like you’re desperate for a loan.

Large purchases: Most of us use credit cards to make large purchases, especially online. However, if you haven’t paid off that large purchase quickly enough, it could result in a reduction of your credit score. This is because you are decreasing your credit utilization (the more credit you have available but aren’t using, the better your credit score will be).

Errors: Not all sudden drops in credit score are through fault of your own. Sometimes, a clerical error/mistake on your credit report can decrease your credit score. The most common errors would be closed account still being marked as open or on-time payments being marked as late.

Repayments: This will sounds confusing, but paying off a big loan (like a car) can actually decrease your credit score, at least for a while. Your credit score is better if you’ve got a mix of different credit on the go, such as mortgages and credit cards. If you pay off one of those then the variety of it is decreasing and your credit score will follow.

Remember though, just because your credit score can fluctuate that doesn’t mean you shouldn’t pay off large loans! If you stress out about every change on your credit score you’ll go crazy. Just do what makes the most sense financially and your score will increase over time.

Frequently Asked Questions:

Q. Should I use multiple credit cards?

A. It depends on your situation, much like most financial decisions. If you’re a financial expert then multiple credit cards could be very helpful and you can build credit score quite quickly. If you’re not a financial expert then it could be a mistake and could put you in a much worse financial situation.

This process will take time, years even, but with some dedication and good methods you can rebuild your credit score.

We’ll help you find a fair priced car loan in Southern Ontario no matter what your credit score is. Click here to get pre-approved online with us at Click to Drive in Brantford, or click here if you have any questions or inquiries about rebuilding credit score in Ontario.