Next Steps After Being Rejected for a Car Loan

It can happen to anyone. Here’s what you should do next to get approved. Updated for 2023.

Were you recently denied a car loan? Don’t worry, it’s not the end of the world just yet! Car loan rejection can happen to anyone no matter how good your credit score is. We’ll cover all things related to car loan rejection.

Common Reasons for Car Loan Rejection

Whenever a car loan application comes in, it first goes through a process which determines whether you meet the initial qualifying criteria. In most cases, that determination is made by an AI rather than an actual human. There are 6 key reasons for car loan rejection in Brantford. Let’s go through them.

Asked for too much: Everyone has a limit somewhere which lenders will not be willing to lend above. If you try and get a loan above that limit then they’ll just flatly reject it and you’ll need to ask for less.

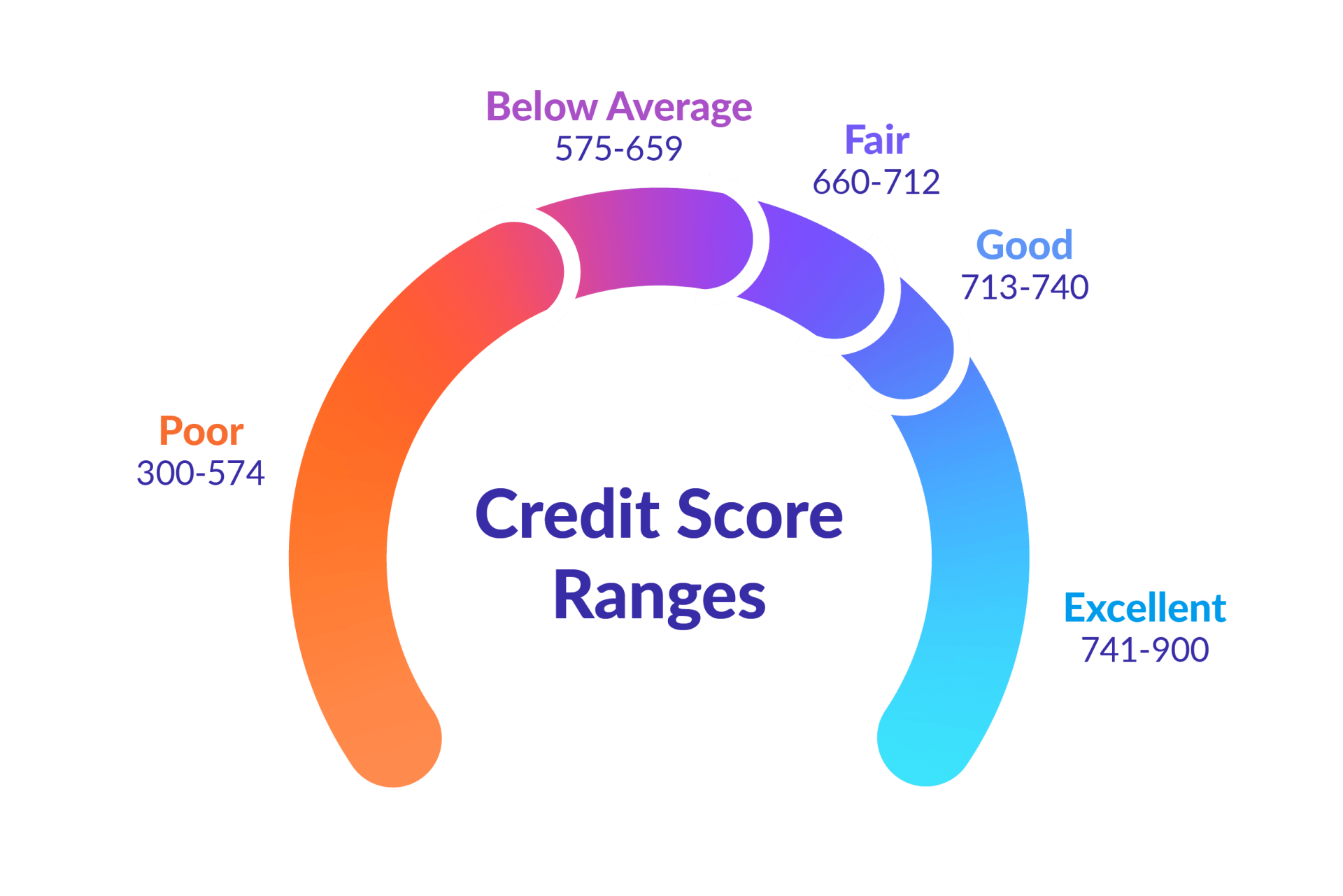

Bad Credit: Lenders will be weary to give you a loan if you have bad credit score. In other words they won’t see you as a reliable borrower. Anyone with credit score under 600 will have a hard time being approved for a car loan. Unless you apply with us! We offer guaranteed approval for all credit situations and $0 down. Apply here today!

No Credit: No credit is common for young adults and newcomers to Canada, Having no credit is a separate issue from having bad credit. Lenders don’t like that because you have no history. Having no credit makes it hard to prove to a lender that you are a reliable lender. If you have no credit, click here to learn how to build up your credit score.

Application errors: Sometimes it’s just as simple as a mistake on your application. These things happen more often than you’d think but often ends in a car loan rejection because the lender has no idea if it was an honest mistakes or a lie.

High DTI (debt to income) ratio: DTI is a simple calculation of your income minus your debt. If the lender finds your debt too high relative to your income, around 50% of lenders will reject your Branford car loan application because they assume you have too many loans already.

Unstable Income: Lenders like consistency because it means you’re more likely to be able to meet loan payments. Therefore if your recent income history is inconsistent, they might reject your application.

This unstable income could come from having a new job, being between jobs, or are self employed and work on commission/contract. If this is the case, you’ll still be able to get approved, you just need to prepare a lot more paperwork.

What to do After Car Loan Rejection in Brantford

Unfortunately, loan lenders tend to not tell you up-front why your car loan was rejected. Usually they’ll give you a reason if you ask, but if they don’t, you’re going to have to try and figure it out by yourself. Check your credit score, your DTI, and make sure there are no errors anywhere. It could be any of those things.

Once you’ve learned the reason you were denied a Brantford car loan, the fix will depend on the problem. Some problems will be faster and easier to fix than others.

If the issue was an error on your application, simply fix the errors and re-applying for the loan should do it. This also applies for if you asked for too big of a loan.

If the issue is that you have bad or no credit score then you’ll need to build up your score before re-applying for a car loan. To learn how to increase your credit score quickly click here. However, if you don’t have time to build your credit score in we’d love to help. We offer guaranteed approval on al credit scores with $0 down in most cases. Apply here!

If the issue is a high DTI, the only thing you can really do next is pay off some of your pre-existing loans to lower your DTI. Remember, the lower your DTI, the more willing a lender will be to hand you a loan.

Getting Expert Advice

Another option to help you get approved for a car loan you’ve previously been rejected from is to pay for expert credit advice from a professional, but you have a free resource to your disposal that can not only help you fix/build your credit, but get you a car loan at the same time!

If you’ve been denied a car loan in Brantford and are ready to apply again, apply with us! We offer great affordable pricing on 1,000+ vehicles and have guaranteed approval with all credit scores.