What Defines a Good Interest Rate for a Car Loan in Canada?

Have you ever wondered what truly makes an interest rate good when it comes to financing your dream car? It’s a question that many Canadian car buyers grapple with as they step into the world of auto loans. While we can’t unravel all the mysteries of the financial world, we can certainly shed some light on the factors that define a good interest rate for a car loan in Canada.

The Starting Point: Prime Rate

To comprehend the realm of car loan interest rates, you must first acquaint yourself with the prime rate. The prime rate serves as the foundation for many interest rates in Canada, acting as a benchmark for lending costs. Financial institutions tend to set their interest rates based on the prime rate, adjusting them as the prime rate fluctuates.

Credit Score Dance

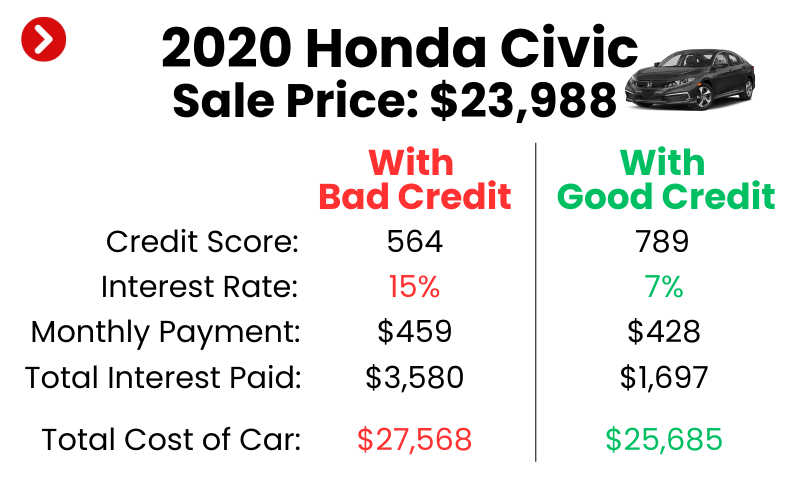

Your credit score is an indispensable dance partner in the world of interest rates. Think of it as your financial tango; the better you dance, the sweeter the tune. A good credit score, typically starting around 660 in Canada, opens the door to lower interest rates. Lenders perceive borrowers with strong credit scores as less risky, granting them access to more favorable rates.

Term Matters

Consider the term of your car loan as a vessel sailing through the sea of interest rates. The loan term, or the duration over which you agree to repay the loan, can have a considerable impact on your interest rate. Shorter terms often carry lower interest rates, while longer terms may have slightly higher rates. This is because longer terms expose lenders to a greater degree of risk.

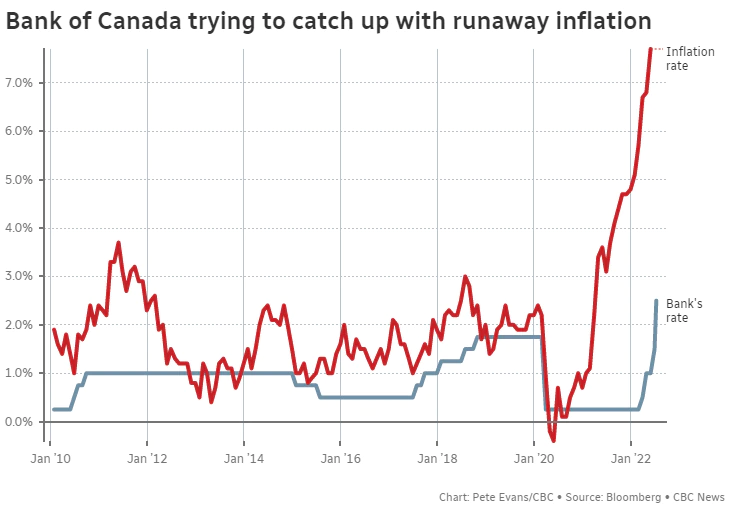

Influence of the Economy

As the tides of the Canadian economy ebb and flow, so do interest rates. The broader economic landscape plays a pivotal role in determining what’s considered a good interest rate for a car loan. When the economy thrives, interest rates tend to rise, reflecting the cost of borrowing. Conversely, during economic downturns, interest rates are often lowered to stimulate borrowing and spending.

Down Payments: A Show of Commitment

Picture the down payment as your initial investment in a financial partnership. A substantial down payment showcases your commitment to the car loan and signals to the lender that you’re invested in the process. This level of commitment can sometimes influence lenders to offer more favorable interest rates, rewarding your dedication to the agreement.

The Industry’s Secret: Competition

Ah, the undercurrent of competition – a powerful force shaping the world of car loan interest rates. Lenders vie for your business, and their rates reflect this battle for attention. As a savvy Canadian car buyer, you’re at an advantage. The more lenders compete for your loan, the more likely you are to snag a good interest rate.

Wrangling the Wild Interest Rate

So, what truly defines a good interest rate for a car loan in Canada? It’s a blend of several factors: the prime rate, your credit score, the loan term, economic fluctuations, your down payment, and the competitive landscape. The interplay of these elements ultimately determines whether an interest rate is favorable or not. While we can’t predict the future, we can navigate the present with the wisdom that a solid credit score, shorter loan terms, economic awareness, and a hearty down payment can certainly tip the scales in your favor.

As you venture into the world of car financing, remember that the concept of a good interest rate is not set in stone. It’s a dynamic figure influenced by myriad variables, and staying informed is your best weapon. Keep your financial wits about you, and the road to that new car may be smoother than you imagined.

In the intricate tapestry of Canadian car loans, understanding the nuances of a good interest rate is your key to unlocking a more affordable driving dream.