Purchasing a car in Canada is a significant financial decision, and for many individuals, securing a car loan is an essential step towards making their dream of owning a vehicle a reality.

However, obtaining approval for a car loan can be a daunting task, especially if you are unfamiliar with the process or unsure about your eligibility.

In this comprehensive guide, we will explore various key factors that can help you improve your chances of getting approved for a car loan in Canada.

1. Build a Strong Credit History

A strong credit history remains a critical factor in obtaining approval for a car loan. Lenders often assess an applicant’s creditworthiness to determine their ability to repay the loan. To strengthen your credit history:

a. Pay Bills on Time: Make sure you pay all your bills, including credit cards, utility bills, and loans, on time every month.

b. Clear Outstanding Debts: Reducing or eliminating outstanding debts can positively impact your credit score.

c. Monitor Credit Report: Regularly check your credit report for inaccuracies and address any discrepancies promptly.

2. Save for a Down Payment

Having a substantial down payment can significantly increase your chances of approval. A down payment reduces the amount you need to borrow, thereby reducing the lender’s risk. Aim to save at least 10% to 20% of the car’s purchase price as a down payment.

Zero down payment financing is also an option if you’re in a rush and need a car right away. Click here to learn more about that.

3. Stable Employment and Income

Lenders prefer borrowers with stable employment and a consistent income stream. A steady job history and a reliable source of income provide assurance to lenders that you can make regular loan payments. Be prepared to provide proof of income, such as pay stubs or tax returns.

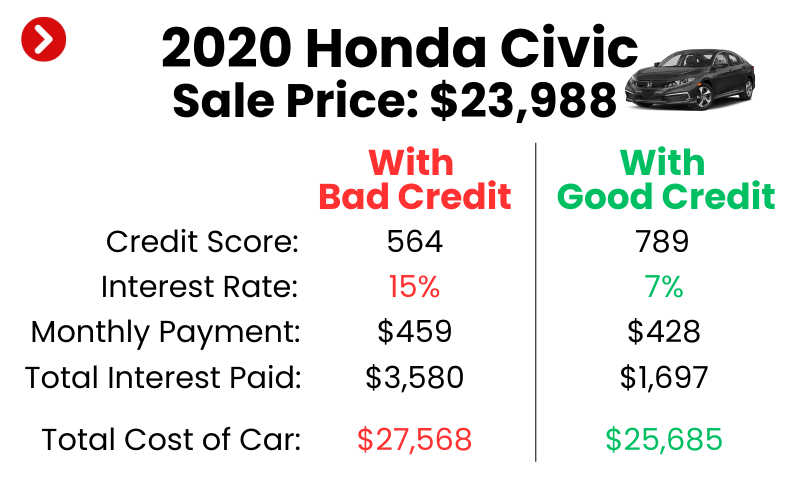

4. Calculate Affordability

Before applying for a car loan, assess your financial situation to determine how much you can comfortably afford to repay each month. Experts suggest that your total monthly car expenses, including loan payments, insurance, and maintenance, should not exceed 15% of your monthly income.

5. Get Pre-Approved

Consider seeking pre-approval from various lenders without mentioning specific institutions. Pre-approval allows you to know the loan amount you qualify for, the interest rate, and the loan terms. Having pre-approval in hand also puts you in a better negotiating position when you visit a dealership.

6. Consider a Co-Signer

If you have a limited credit history or poor credit, having a co-signer with a strong credit profile can enhance your chances of approval. A co-signer essentially guarantees that they will make loan payments if you default, providing the lender with added security.

7. Choose the Right Vehicle

When applying for a car loan, the vehicle you choose can impact the lender’s decision. Opt for a reliable, affordable, and well-maintained vehicle that fits within your budget. Lenders may be hesitant to finance expensive or high-maintenance vehicles for individuals with limited credit history or lower incomes.

You’re Ready to Get Approved For a Car Loan!

Securing approval for a car loan in Canada requires careful preparation, responsible financial management, and an understanding of what lenders look for in borrowers.

By focusing on building a strong credit history, saving for a down payment, and demonstrating stable employment and income, you can increase your chances of obtaining a favorable car loan.

Additionally, seeking pre-approval and considering a co-signer can further bolster your application. Remember, each lender has its own criteria, so explore different options to find the best fit for your needs.