Being self-employed offers several benefits, such as flexibility and independence, but it can also present unique challenges when it comes to purchasing a car. Traditional financing options like banks and credit unions might be less accessible, but fear not – there are still plenty of avenues for self-employed individuals to obtain their dream vehicle in Canada.

In this article, we’ll explore the various steps and considerations involved in buying a car when you’re self-employed.

Understanding Your Financial Situation

Before diving into the car-buying process, it’s crucial to assess your financial standing as a self-employed individual. Unlike salaried employees, your income may not follow a predictable pattern, making it essential to review your cash flow and determine how much you can comfortably allocate to a car purchase.

Carefully analyze your business earnings, expenses, and savings to establish a budget for the car you wish to buy.

Documentation Requirements

When applying for a car loan, self-employed individuals typically face more rigorous documentation requirements compared to salaried employees. To prepare for the process, gather the following documents:

a. Proof of Income: Provide at least two years of tax returns, including the T1 General form and the Statement of Business or Professional Activities (Form T2125). These documents showcase your business income and help lenders evaluate your ability to repay the loan.

b. Bank Statements: Lenders may request several months of personal and business bank statements to verify your financial stability and cash flow.

c. Business Registration and Incorporation Documents: If you operate as a registered business or corporation, have the necessary paperwork ready to demonstrate the legitimacy of your enterprise.

d. Identification: Standard identification documents, such as a valid driver’s license and passport, will be required for identification purposes.

Building a Strong Credit History

A healthy credit history can significantly impact your ability to secure favorable financing terms. Paying bills on time and managing your debts responsibly will help strengthen your creditworthiness and improve your chances of obtaining financing through other channels.

Exploring Alternative Financing Options

There are several options tailored to self-employed individuals looking to buy a car in Canada. Consider exploring financial institutions that specialize in providing loans to self-employed individuals, like us!

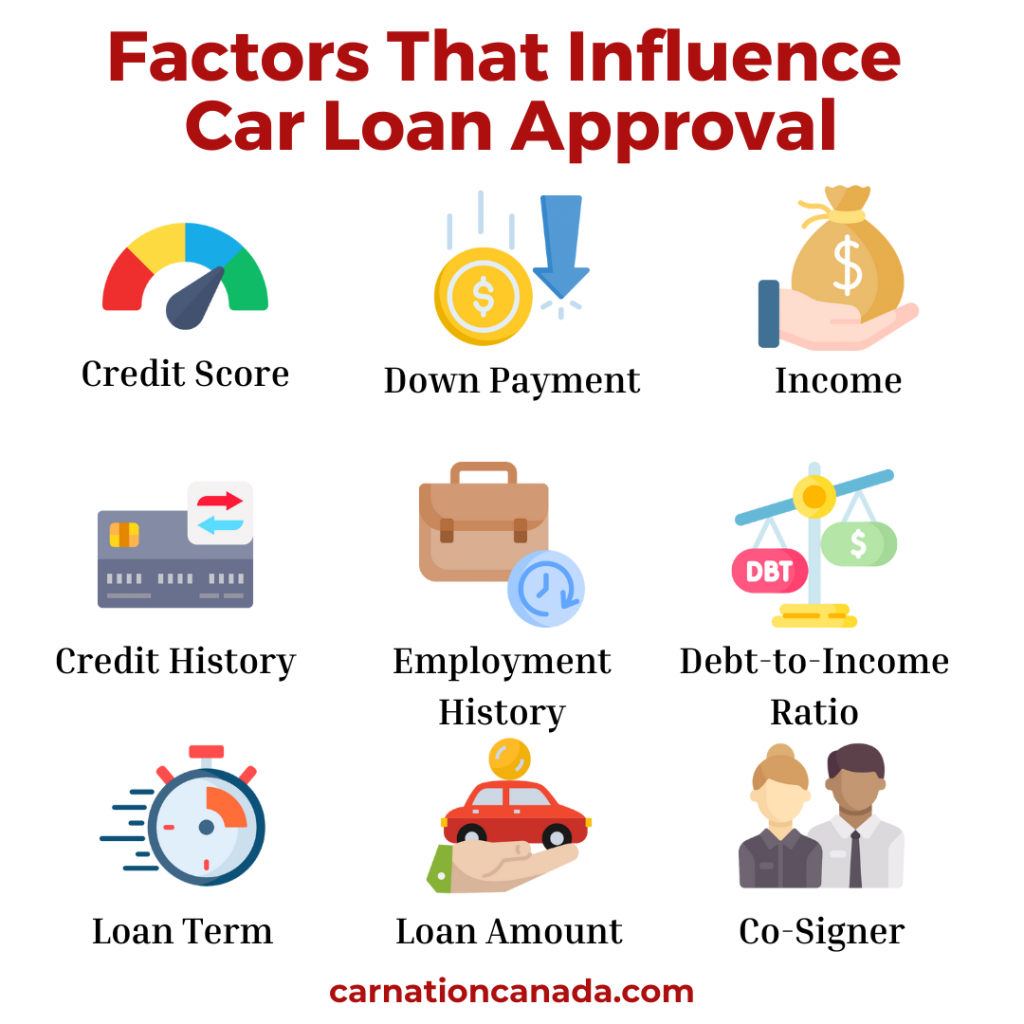

These lenders often take a more holistic approach to evaluating loan applications, considering factors beyond just your credit score.

Down Payment Considerations

Making a substantial down payment can work in your favor when buying a car when self-employed. A larger down payment can reduce the overall amount you need to finance and may increase your chances of approval with alternative lenders.

It also showcases your commitment to the purchase and may lead to more favorable loan terms. If you can afford the loan payments, $0 down car financing is also an option. Click here to learn more about that.

Researching and Choosing the Right Car

With the financial aspects sorted out, focus on researching and selecting the right car for your needs. Consider factors like fuel efficiency, maintenance costs, insurance premiums, and whether it aligns with your business requirements if you plan to use the car for work-related purposes.

Negotiating the Deal

Once you’ve found the car you want, it’s time to negotiate the deal with the dealership. Research the fair market value of the vehicle and use that information to negotiate a reasonable price. Remember to factor in any additional costs like taxes, registration fees, and extended warranties when finalizing the deal.

You’re Ready for a Self-Employed Car Loan

As a self-employed individual in Canada, buying a car may require a bit more effort and documentation compared to salaried employees. However, with careful financial planning, preparation, and exploring alternative financing options, you can successfully purchase the car you desire. Remember to remain patient and diligent throughout the process, and always make informed decisions that align with your business and personal financial goals.