If you’re dead set on a particular car, the one you’ve always dreamed about, but it’s just out of reach, then it’s time to start saving up. Saving up can be tricky but this article will give you the best tips and tricks to finally save for the car you actually want to buy.

Know Your Goals

The first step of saving up for the car you actually want to buy in is figuring out how much you need to save up. The best place to start is the down payment. If you know the price of the car that you want then it’s simple enough to calculate what your down payment should be, aim for around 20% of the car’s total cost. Saving up more than that won’t hurt but that’s the minimum you’re aiming for.

The second thing you need to consider is monthly payments and with a little time you can calculate those too. Take the remaining 80% of the car’s cost, and then do a little research to figure out what the average interest rate will be. Once you know these numbers you could do the calculations yourself, or you could work smart and use an online interest calculator.

Create A Budget

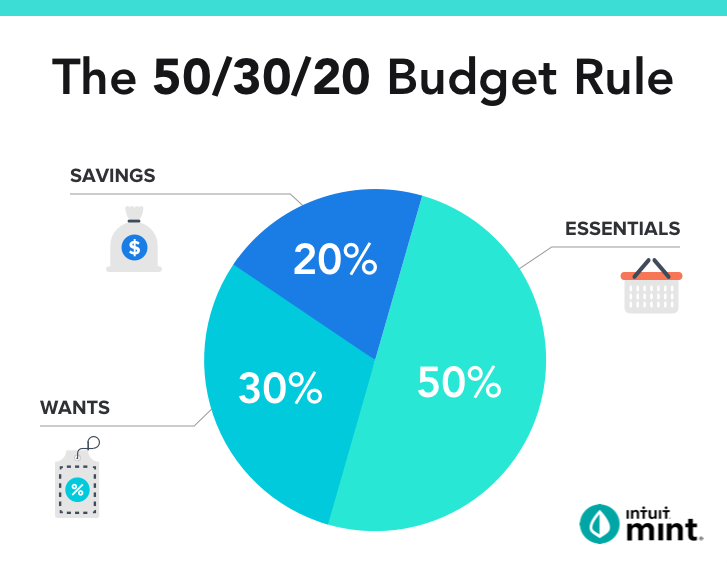

You’ve got your goal, now it’s time to figure out what you’re working with. Set up a spreadsheet and track all of your incoming and outgoing expenses from the last month. Any time money enters or leaves your hands get it written down be it mortgage payments or impulse purchases.

Take all of the incoming money, subtract all of the outgoing money, and whatever’s leftover is what you’ve got to work with. Doing this will also make it crystal clear where money is being spent needlessly and where you can afford to cut down, that’s the key to savings, figuring out where you can be freeing up some extra to save money on a car.

Set Up a Savings Account

You’re going to need a place to save up the money and a savings account is naturally the best place to do it. Savings accounts are useful for 2 reasons. 1. they gain interest overtime which means having savings earns money which is very nice, 2. having your savings in a separate account from your regular finances means you’re much less likely to spend it which is what you want, your savings are separate for a reason.

With the numbers you’ve got you should be able to calculate how long saving up will take, and if it’s more than a few years then you can use a high interest savings account to make the most of that time.

A savings account also allows you to automate this process. You can set up a recurring monthly deposit to your account so that it just becomes a regular part of your expenses and you’re always saving up, even if you forget.

Following this process should get you one step closer to the car of your dreams. Thanks for reading! If you have any more questions, please don’t hesitate to contact us.