When it comes to purchasing a car, securing financing is often a crucial step in the process. Getting pre-approved for a car loan allows you to understand your budget, streamline your car shopping experience, and negotiate better terms with car dealerships. In this article, we will explore the steps involved in obtaining a pre-approved car loan and offer useful tips to ensure a smooth financing process

Tips For Getting Pre-Approved For a Car Loan

Know Your Credit Score: Before applying for a car loan, it is essential to familiarize yourself with your credit score. Lenders use credit scores to assess your creditworthiness and determine the interest rate you qualify for. Obtain a free copy of your credit report from one of the major credit bureaus (Experian, TransUnion, or Equifax) and review it for any inaccuracies. If you have a good credit score, you are more likely to secure a favorable interest rate.

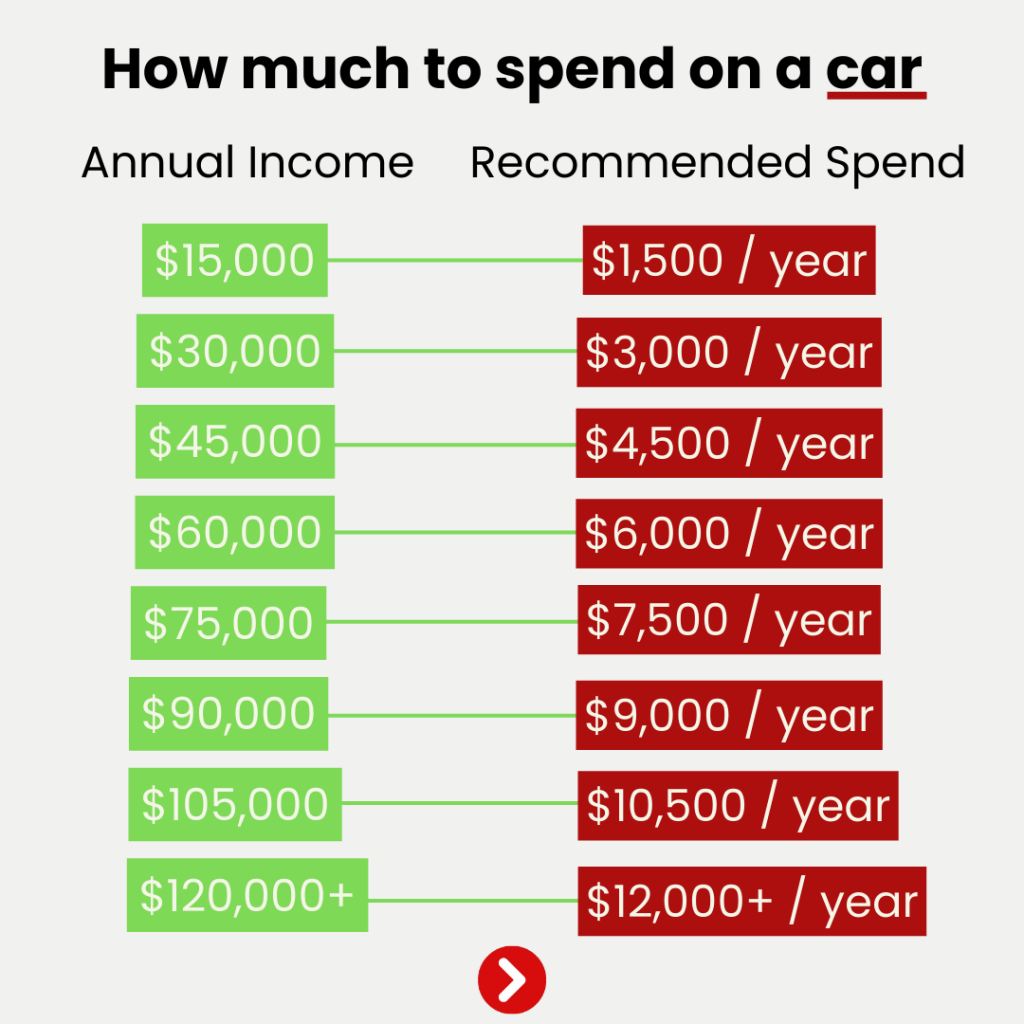

Assess Your Financial Situation: Take a close look at your current financial situation to determine how much you can comfortably afford to borrow. Consider your income, monthly expenses, and any existing debts. Use online calculators to estimate monthly payments based on different loan terms and interest rates. Having a clear understanding of your financial capabilities will help you make informed decisions during the car-buying process.

Research Lenders: Research various lenders to find the ones that offer competitive interest rates and terms for car loans. Explore online financial institutions and traditional banks that specialize in auto financing. Check their eligibility criteria and lending terms to ensure they align with your needs. Look for lenders that offer pre-approval options, as this allows you to understand the terms and conditions of the loan before committing.

Gather Necessary Documents: To complete the pre-approval process smoothly, gather the necessary documents that lenders typically require. These may include:

Proof of identity: Valid driver’s license, passport, or government-issued ID.

Proof of income: Recent pay stubs, W-2 forms, or tax returns for self-employed individuals.

Proof of residence: Utility bills, lease agreements, or mortgage statements.

Bank statements: Provide several months of bank statements to demonstrate your financial stability.

Getting Pre-Approved For a Car Loan

1. Submitting the Application

Once you have chosen a lender, visit their website or contact their loan department to initiate the pre-approval process. Provide the required documents and fill out the application accurately. Double-check for any errors or omissions before submitting to ensure a seamless review process. Many lenders offer online applications, making them convenient and time-saving.

2. Loan Pre-Approval Process

The lender will review your application, assess your creditworthiness, and determine the maximum loan amount they are willing to offer. They will consider factors such as credit score, income, employment stability, and debt-to-income ratio. The lender may run a hard credit inquiry during this stage, which could temporarily affect your credit score.

3. Reviewing the Pre-Approval Terms

Once the lender completes the review process, they will provide you with a pre-approval letter or certificate. This document outlines the loan amount you are approved for, the interest rate, and any specific terms and conditions. Carefully review the terms and ensure they align with your expectations and financial goals.

4. Begin Car Shopping

Armed with your pre-approval, you can now start shopping for your dream car within your budget. Having a pre-approved loan in hand gives you the advantage of negotiating with car dealerships as a cash buyer, potentially helping you secure a better deal. Compare prices, features, and models to find the best fit for your needs and budget.

5. Finalizing the Loan

Once you have selected the car and negotiated the price, contact the lender to finalize the loan. Provide them with the details of the car, including the vehicle identification number (VIN), to complete the loan documentation process. The lender will guide you through the remaining paperwork, and upon completion, they will transfer the funds directly to the dealership.

You’re Ready to Get Pre-Approved!

Getting pre-approved for a car loan is a smart move that simplifies the car buying process and puts you in a stronger position when negotiating with car dealerships. By knowing your credit score, assessing your financial situation, researching lenders, and following the pre-approval process, you can secure a loan that aligns with your budget and financial goals. With careful planning and preparation, you’ll be driving off in your new car with confidence and peace of mind.