Purchasing a car is a significant financial decision for many individuals. While some buyers are fortunate enough to pay for a vehicle upfront, the majority rely on car loans to make their dreams of owning a car a reality. When applying for a car loan, one of the crucial factors lenders consider is the borrower’s credit score. In this article, we will delve into the importance of credit scores in obtaining a car loan and explore the minimum credit score requirements that borrowers should be aware of.

The Significance of Credit Scores

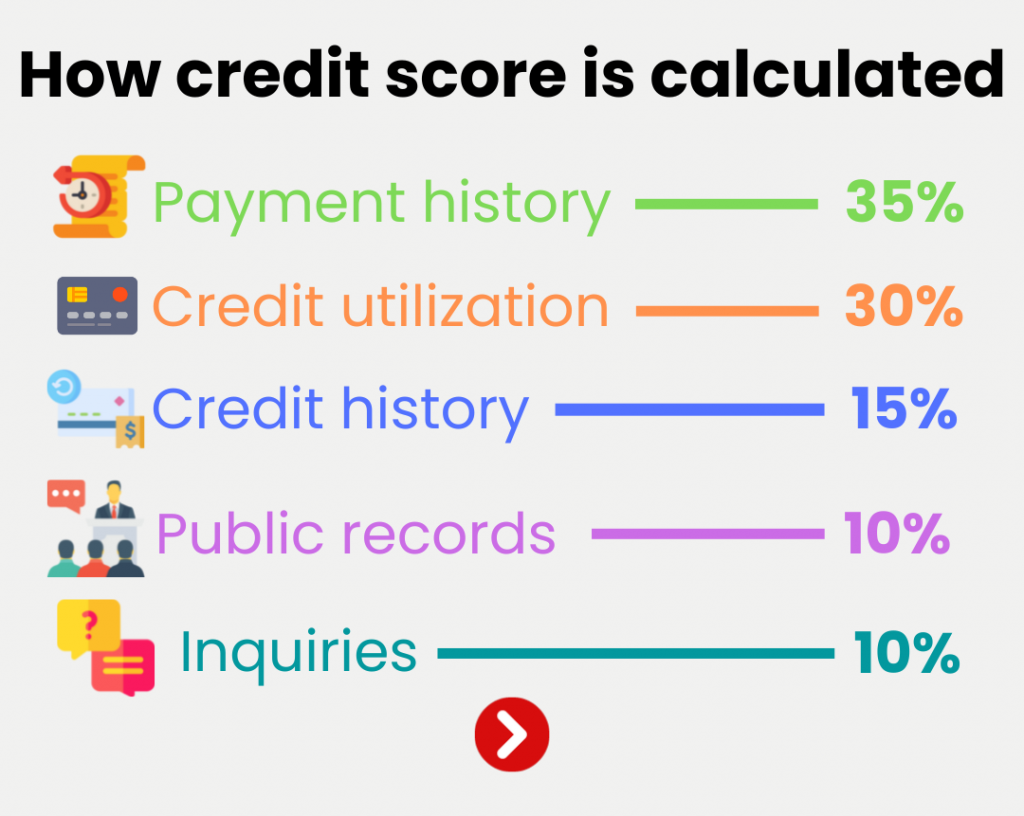

Credit scores play a pivotal role in the lending industry as they provide lenders with an assessment of a borrower’s creditworthiness. These scores are calculated based on several factors, including payment history, credit utilization, length of credit history, credit mix, and recent credit inquiries. A credit score helps lenders determine the level of risk associated with lending money to a particular individual.

Minimum Credit Score for a Car Loan

While specific credit score requirements can vary from one lender to another, there are generally accepted minimum credit scores that borrowers should aim for when seeking a car loan. It’s important to note that these scores serve as guidelines and not rigid thresholds. Lenders may consider other factors, such as income and employment history, alongside the credit score.

Prime Credit Score

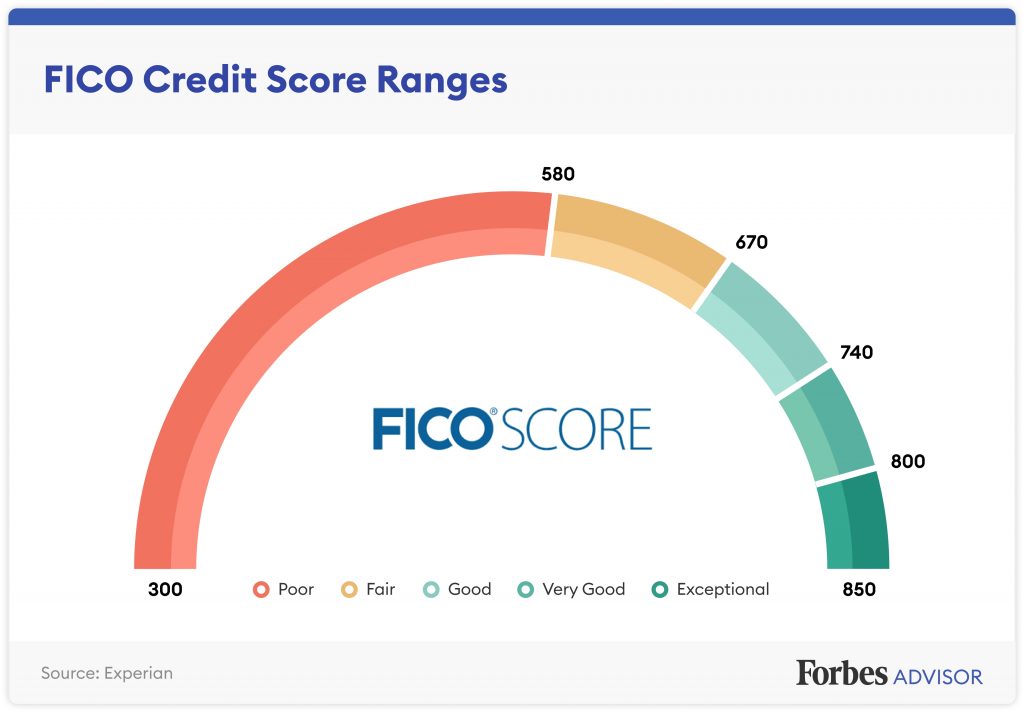

Prime credit scores typically range between 661 and 850, according to the FICO credit scoring model. Borrowers with a prime credit score are considered to have excellent creditworthiness and are likely to be offered the most favorable interest rates and loan terms by lenders. Generally, having a prime credit score greatly increases the chances of getting approved for a car loan.

Near Prime Credit Score

A near-prime credit score usually falls within the range of 601 to 660. Borrowers in this category are still regarded as having good creditworthiness. While they may not be offered the most competitive interest rates, they are generally eligible for car loans from traditional lenders.

Subprime Credit Score

Subprime credit scores, ranging from 501 to 600, indicate a moderate level of credit risk to lenders. Borrowers with subprime scores may find it more challenging to secure a car loan from traditional lending institutions. However, alternative lending options may be available to borrowers with subprime credit scores, albeit at higher interest rates and stricter terms.

Deep Subprime Credit Score

Deep subprime credit scores are typically below 500. Individuals in this category face significant challenges when seeking a car loan through traditional lenders due to their poor credit history. In such cases, borrowers may need to explore alternative financing options or work towards improving their credit score before applying for a loan.

Improving Credit Score for a Car Loan

Even if your credit score falls below the desired range, there are steps you can take to improve it over time:

- Pay bills on time: Consistently making timely payments for all your financial obligations positively impacts your credit score.

- Reduce debt: Aim to keep your credit utilization ratio low by paying down outstanding debts.

- Maintain a diverse credit mix: A combination of different types of credit, such as credit cards and loans, can positively affect your credit score.

- Limit credit applications: Frequent credit inquiries can negatively impact your credit score. Apply for credit only when necessary.

You’re Ready for a Car Loan!

Understanding the significance of credit scores is crucial when applying for a car loan. While minimum credit score requirements can vary among lenders, aiming for a prime or near prime credit score significantly increases the likelihood of obtaining favorable loan terms. For borrowers with lower credit scores, alternative financing options may be available, albeit at less favorable terms. By working towards improving their credit scores over time, individuals can enhance their chances of securing a car loan and potentially save money in the long run.