Leasing a car can be an attractive option for those who need a vehicle but don’t want to commit to a long-term car loan. However, leasing a car with bad credit can be a challenging task. Many lenders use your credit score to determine your eligibility for a lease and the terms of the lease agreement, including the monthly payment amount and the interest rate.

If you have bad credit, you may be wondering if it’s even possible to lease a car. The answer is yes, but it may come with some challenges. In this article, we’ll explore what you need to know about leasing a car with bad credit in Canada.

- Know Your Credit Score

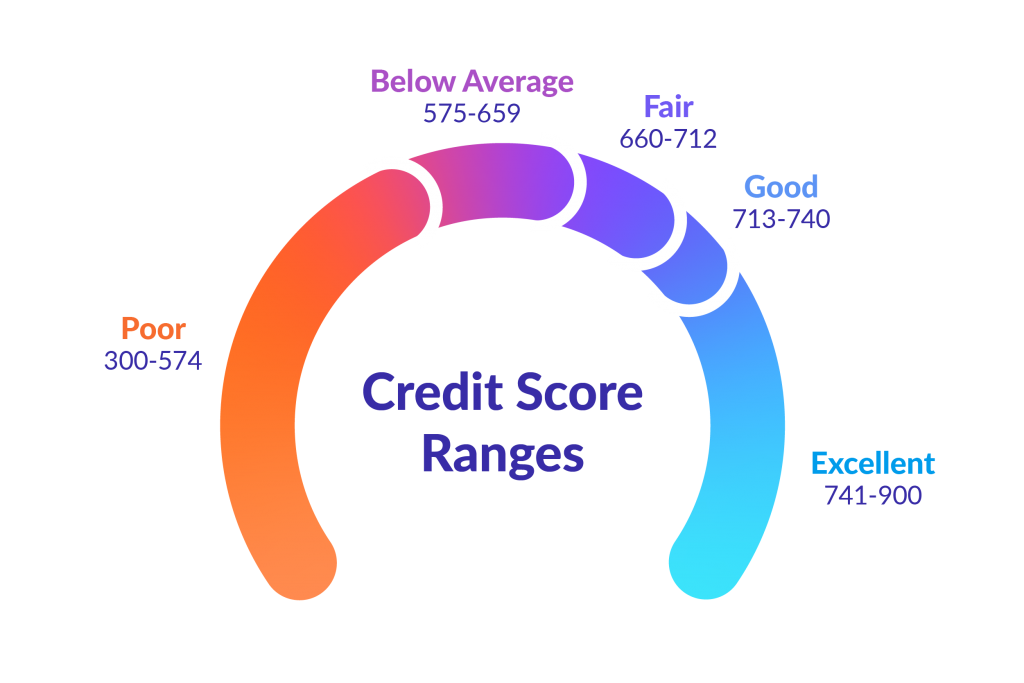

The first step to leasing a car with bad credit is to understand your credit score. Your credit score is a number between 300 and 900 that represents your creditworthiness. The higher the score, the better your credit is. Lenders use your credit score to determine the likelihood of you paying back the loan or lease on time. If you have bad credit, which is typically a score below 600, you may have trouble getting approved for a lease.

- Look for Lenders That Accept Bad Credit

Not all lenders require a high credit score to lease a car. Some lenders specialize in working with people who have bad credit. These lenders are called subprime lenders. They offer lease agreements with lower credit requirements, but they may come with higher interest rates and fees. It’s essential to research subprime lenders and compare their lease terms and fees to find the best deal.

- Consider a Co-Signer

If you have bad credit and can’t find a subprime lender that meets your needs, you may want to consider a co-signer. A co-signer is someone with good credit who agrees to take responsibility for the lease agreement if you can’t make the payments. Having a co-signer can increase your chances of getting approved for a lease and may result in better lease terms.

- Be Prepared to Pay a Higher Down Payment

If you have bad credit, you may be required to pay a higher down payment when leasing a car. A higher down payment reduces the amount of money the lender has to finance and reduces the risk of the lease. By paying a higher down payment, you may be able to secure a lease with more favorable terms.

- Work on Improving Your Credit

While it’s possible to lease a car with bad credit, it’s always a good idea to work on improving your credit score. Improving your credit score can help you get better lease terms and lower interest rates in the future. Some ways to improve your credit score include paying bills on time, reducing credit card balances, and disputing errors on your credit report.

In conclusion, leasing a car with bad credit is possible, but it may come with some challenges. It’s essential to research lenders that accept bad credit, consider a co-signer, be prepared to pay a higher down payment, and work on improving your credit score. By doing your research and being prepared, you can find a lease agreement that works for you and your budget.

Thanks for reading! if you have any more questions, please contact us here.