Being stuck with a loan looming over your head can be a real pain. Nobody likes being in debt, but sometimes you’ve got no choice. Worry not, there are many ways you can speed up the process of paying off a loan which this article will go over..

1. Round Up Your Payments

This is probably the simplest thing you can do to speed up the process. If you’re paying a minimum of $230 a month, round it up to $250. You’re unlikely to miss an extra $20 a month, but it will do wonders in the long term to your loan repayments. After 12 months, That’s an extra $240 paid, a full extra payment.

If you’ve got the money to spare you can round up even higher. Keep an eye on how much money you’ve got at the end of the month, if you have an extra $50 free after food, rent, fuel, entertainment. Then you may be safe to add that to your loan repayments too.

2. Find Some Extra Cash

If you have the stamina and work ethic for a second job, fantastic. Put all of that extra towards the loan. However, most people don’t have that kind of stamina.

If you need to find some money do a thorough look through your home. You most likely have plenty of things that you’re never going to use and don’t really want anymore that you can sell off on Kijiji or Ebay. make sure any money you make goes straight into loan payments. Big or small, every little helps.

3. Make Bi-Weekly Payments

This can be a complicated one to get your head around but here’s how it works. If you switch to a Bi-weekly repayment model, which means half payments every 2 weeks instead of 1 full payment every month, you actually end up making a full extra payment every year.

This method is undoubtedly faster, however it also requires a big commitment, it can be much harder to pay on a bi-weekly schedule vs a monthly one. Besides that. Some loan companies will charge you for doing it this way since it is faster and they’ll lose out on interest money.

If you’re handy with a calculator you can crunch the numbers and figure out if it will still save you in the long run regardless.

4. Refinance The Loan

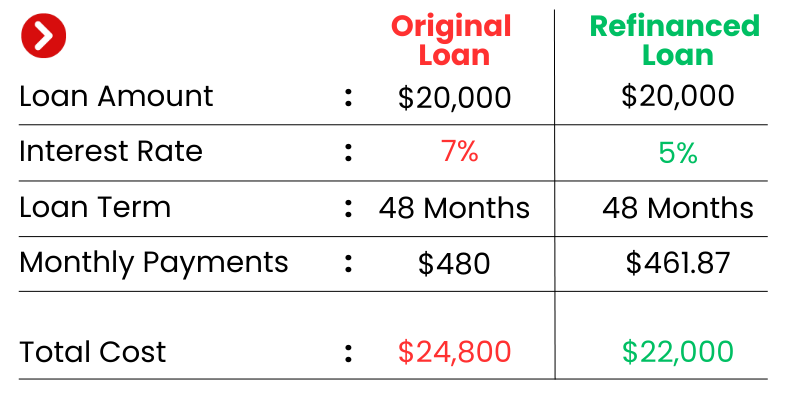

Assuming you have a good credit score this can be a great option. Refinancing is basically taking the loan you have and moving it to someone else who has a better interest rate. It’s a bit more complicated than that but that’s the jist of it.

You’ll still have to pay the full amount, however, a lower Interest rate, even going from 5% to 4% will make a big difference in how quickly you can bring those numbers down. Not sure if you should refinance your car loan? Click here for an article that should help you figure it out.

Why is Paying Off a Car Loan Early Difficult?

You might have discovered that it’s much harder than just paying a few extra dollars a month. Why is that?

Minimum Interest

Something that should be made clear is that Lenders, including banks, are a business and lending money is their primary money making tool. Interest is how they make that money. Once you understand this you can understand why they make it so difficult to repay a loan early.

Interest is usually added to a loan on a monthly basis based on the current balance of the loan. So if you start paying off that loan in bigger chunks, you’ll not only get charged interest less times, but the times you do get charged will become smaller as well. Lenders don’t like that, and on a lot of loan contracts they’ll specify that you simply cannot pay off the loan early, but even if they don’t they have other tricks to employ.

Early Payment Issues

If, say, you get a Christmas bonus from your work (hey, nice job!) and you decide to put some of that money towards your car loan the lender might let you do that, but there’s a trick to it. What will happen if you try to do this is that the automatic payments of your loan will be paused until they catch up.

Say you pay $200 and your monthly payments are $50. For the next four months after that payment the lender simply won’t charge you for those months since “you’ve already paid them”. At the end of those four months absolutely nothing has changed about the amount of time it will take to repay the loan.

Principal Payments

There’s theoretically 2 types of payments you can make against a loan. You can pay against the full amount of the loan including interest, or you can pay specifically the original loan amount which will reduce the amount of interest you accrue later on.

This is theoretical because naturally lenders don’t want you to do this, any payment you make to a loan will default to paying the extras like interest first and the actual amount second.

That’s all! Hopefully you understand a little bit more how to pay off a car loan early and the struggles that come with it. If you have any more questions, please don’t hesitate to contact us!