Our auto loans team helped put together this quick guide on getting a low-interest car loan for your car purchase. We hope it helps!

Understanding Auto Loans & Interest Rates

The majority of us have never taken a finance class, so finance, or specifically, in this case, car loans, may seem complex but we are going to break it down for you. (We are not going to use technical jargon but instead focus on the things that matter to you, the buyer).

Before the deregulation in the late 1990s, if you wanted to finance the purchase of a car you either went to a bank/Caisse Populaire or the dealership offered in-house financing.

Dealerships in the past would finance the purchase through their cash flow but with car prices higher, it makes sense for dealerships to work with lenders that have the working capital needed to fund a large number of deals.

However, as technology allowed businesses and consumers to communicate over vast distances, we have seen a spike in the number of 3rd party lenders who are vying for your business.

While competition is good, there are so many lenders out there advertising their loans that you can have a very tough time figuring out which offer is the best for you.

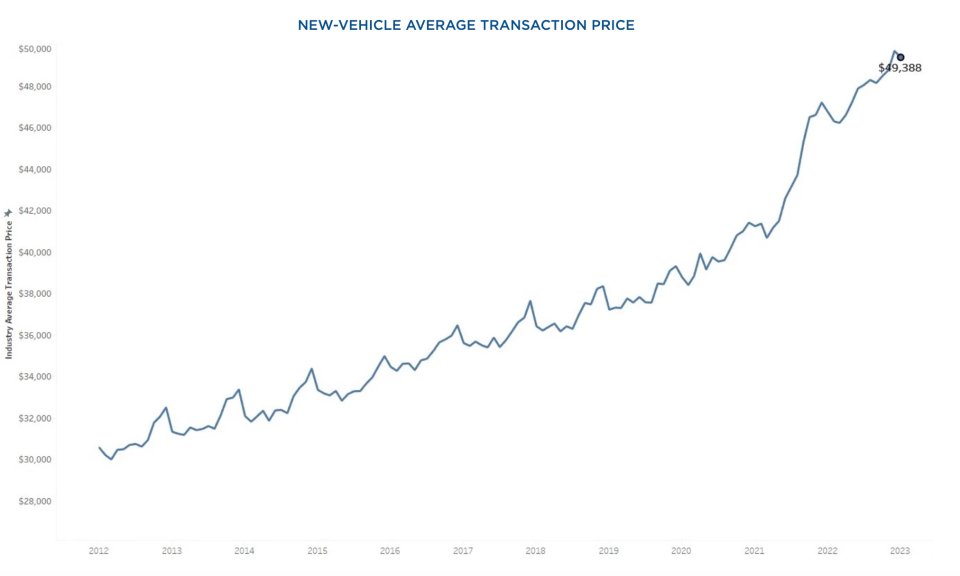

The reason we need to pay close attention to the terms is the average price of a new car can easily reach $50,000 or more, so you need to take every precaution to keep your costs down.

Your credit score is the single biggest factor that determines what interest rate prospective lenders are going to charge.

The higher your score, the less interest you pay. The golden number you need for a low-interest car loan is a 700 or higher credit score. Something that you should do if you have not already, is look at your credit score to see where things stand.

If your score is under 700, you can remedy it by making the personal commitment to always pay your bills in full going forward. The easiest way to do that is to sign up for pre-authorized payments with your creditors.

Having a Verifiable Income is Vital

Your credit score is the biggest influencer but coming in a close second is your income. If you can provide documents that substantiate your income, prospective lenders are going to feel more comfortable approving your car loan. Bring along payslips and bank statements for the lender to review.

Getting a Low-Interest Car Loan With Ease

A surefire way to get the most preferential interest rate is to work with a local dealership. These dealerships have an extensive network of lenders, so you know with confidence that you are getting the best deal.

Aside from having the best interest rate, if you have any credit challenges the credit expert at the dealerships is going to be able to help steer you in the right direction.

The secret to getting a low-interest car loan in Kitchener is to work with a local dealership, so why not reach out and schedule a test drive!