For many individuals, owning a car is a significant milestone, providing convenience, mobility, and freedom. However, for first-time buyers in Canada, acquiring a car through a loan can be a daunting process.

This article aims to guide first-time car buyers through the essentials of obtaining a car loan without mentioning traditional financing methods like banks, credit unions, or other specific lenders.

1. Understanding Your Credit Score

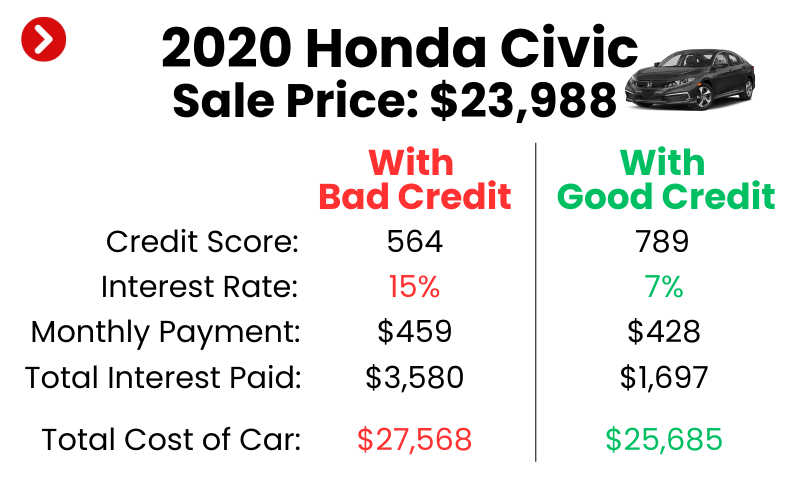

One of the crucial factors in securing a car loan, which is often overlooked by first-time buyers, is their credit score. A credit score is a numerical representation of your creditworthiness, reflecting your history of managing debt and credit.

Credit Score plays a crucial role in determining the interest rate and loan terms you might qualify for. Before applying for a car loan, it is advisable to check your credit score and identify areas for improvement.

2. Research and Budget

Start your car loan journey by researching the types of vehicles that fit your needs, lifestyle, and budget. It’s essential to set a realistic budget that considers not only the monthly car loan payment but also other associated costs such as insurance, maintenance, and fuel.

Stick to your budget to avoid overextending your finances. If you aren’t sure where to start when it comes to figuring out your budget, click here.

3. Have a Down Payment

A down payment is a lump sum amount you pay upfront when purchasing a car with a loan. While some financing options might not require a down payment, it is generally recommended to make one if possible.

A down payment helps reduce the total loan amount and can improve your chances of getting approved for a car loan. By the way, if you’re in a rush for a car right away, buying a car with no down payment is also an option.

4. Try to Find a Co-signer

If you have limited or no credit history, obtaining a car loan can be challenging. In such cases, having a co-signer with a good credit score can significantly enhance your chances of loan approval.

A co-signer is someone who agrees to be responsible for the loan if the borrower defaults, providing the lender with additional security.

5. Online Auto Loan Marketplaces

The digital era has brought about various online platforms that connect car buyers with lenders. Online auto loan marketplaces allow you to compare loan offers from different lenders, offering flexibility and convenience in the loan application process.

These platforms often cater to first-time car buyers and individuals with limited credit history.

6. Dealer Financing Options

While we won’t explore in-house financing or buy here pay here dealerships, it’s essential to know that some dealerships offer financing options tailored for first-time buyers, like us!

These programs might have specific eligibility criteria and interest rates, so it’s crucial to research and inquire about them at the dealership.

7. Loan Term Considerations

When applying for a car loan, consider the loan term carefully. While longer loan terms might offer lower monthly payments, they often lead to higher overall interest costs. Opting for a shorter loan term can help you save money in the long run.

You’re Ready for a first-time car loan!

As a first-time car buyer in Canada, obtaining a car loan can be a manageable process with the right preparation and knowledge. Understanding your credit score, conducting thorough research, budgeting wisely, and exploring available financing options can greatly improve your chances of securing a favorable car loan. Remember to choose a loan that aligns with your financial capabilities and never hesitate to seek guidance from trusted financial advisors if needed. Happy car hunting!