Have you ever wondered how people manage to drive their dream cars without draining their bank accounts? The answer lies in a financial mechanism known as car financing. While you may have heard of it before, the intricate details might still be shrouded in mystery. In this article, we will unravel the enigma of car financing, giving you a comprehensive understanding of how it works and how it could benefit you.

The Basics

When it comes to purchasing a car, many people are deterred by the hefty price tags that accompany new or even used vehicles. This is where car financing comes into play. At its core, car financing is a way to spread out the cost of a vehicle over time.

It’s a process that allows you to drive away with your desired car by paying a manageable amount upfront, known as the down payment, and then dividing the remaining cost into regular installments.

The Role of Interest Rates

As you embark on the car financing journey, one key factor to consider is the interest rate. Interest serves as the lender’s compensation for providing you with the funds to purchase the vehicle.

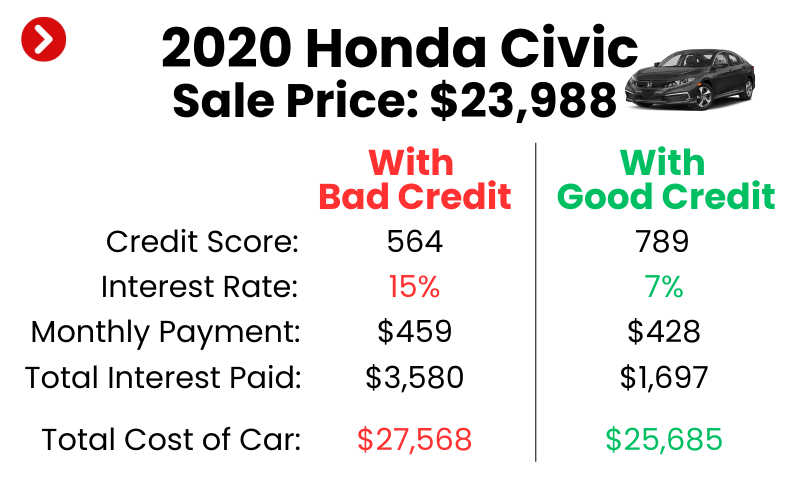

The interest rate you’re offered can significantly impact the total amount you end up paying for the car. A lower interest rate translates to lower overall costs, making it essential to shop around for the best rates available.

To learn more about a good interest rate for a car loan, click here.

Terms and Tenures: Balancing Short-Term vs. Long-Term

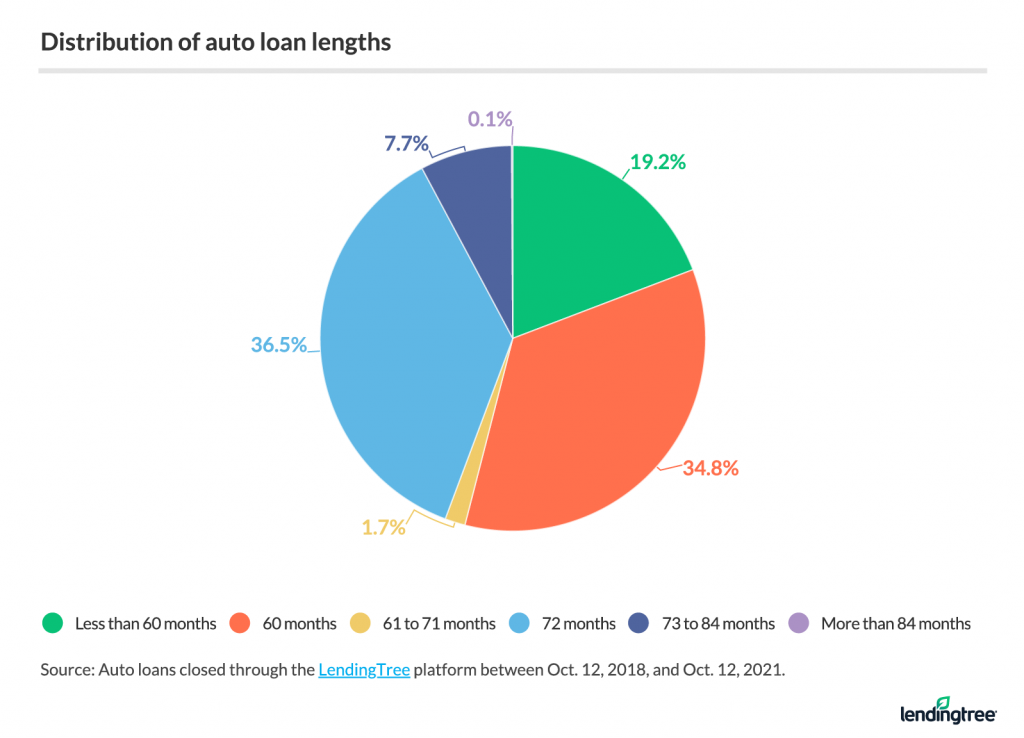

When you explore car financing options, you’ll encounter terms and tenures. The term refers to the duration over which you’ll repay the loan, typically ranging from 24 to 84 months.

While longer terms mean smaller monthly payments, they often come with higher interest rates, increasing the overall cost of the car. Shorter terms, on the other hand, might have higher monthly payments but can lead to substantial savings in interest.

Down Payment and Trade-Ins

Beyond the allure of smaller upfront costs, making a significant down payment or trading in your current vehicle can have a substantial impact on your car financing journey. A down payment reduces the amount you need to finance, leading to lower monthly payments and potentially better interest rates.

Similarly, trading in your existing vehicle can offset the cost of your new purchase, reducing the amount you need to finance and contributing to the equity of your new car.

If you don’t have a trade-in or enough time to save for a down payment, $0 down payment car financing is also available. Click here to learn if this is right for you.

Credit Scores

As you set out to explore car financing options, your credit score emerges as a key player. Lenders use your credit score to gauge your creditworthiness, influencing the interest rate you’re offered.

A higher credit score can open doors to better deals and lower interest rates, making it essential to maintain a healthy credit profile.

Parting Thoughts: Unlocking Access to Your Dream Car

Car financing isn’t just about buying a car; it’s about making your dream car a reality without overwhelming financial stability. By understanding the basics, navigating interest rates, considering terms, optimizing down payments, and being mindful of your credit score, you can unlock the doors to a world of possibilities. Whether you’re eyeing a sleek sedan or a rugged SUV, car financing can be the bridge that connects you to the vehicle you’ve always wanted.

Your Journey Starts Here

In the realm of car financing, every detail counts. From the down payment that sets the stage to the interest rates that shape the total cost, every aspect plays a vital role in the ultimate outcome of your car ownership experience. As you embark on your journey to acquire your dream car, armed with the knowledge of how car financing works, you can confidently navigate the twists and turns, steering you toward a brighter automotive future.