Title: The Key to Unlocking Your Dream Car: Understanding Credit Scores for Financing

Have you ever wondered how lenders decide whether to grant you a car loan or not? It’s not just about the model of the car or your negotiation skills. A critical factor that often shapes the outcome is your credit score. But what exactly is a credit score, and how does it impact your ability to finance a car

The Credit Score Unveiled

At its core, a credit score is a numerical representation of your creditworthiness. It reflects your financial history and how responsible you’ve been with managing credit. Credit scores typically range from 300 to 850, with higher scores indicating better creditworthiness. Lenders use this score to assess the risk of lending you money, including for financing a car.

The Influence on Interest Rates

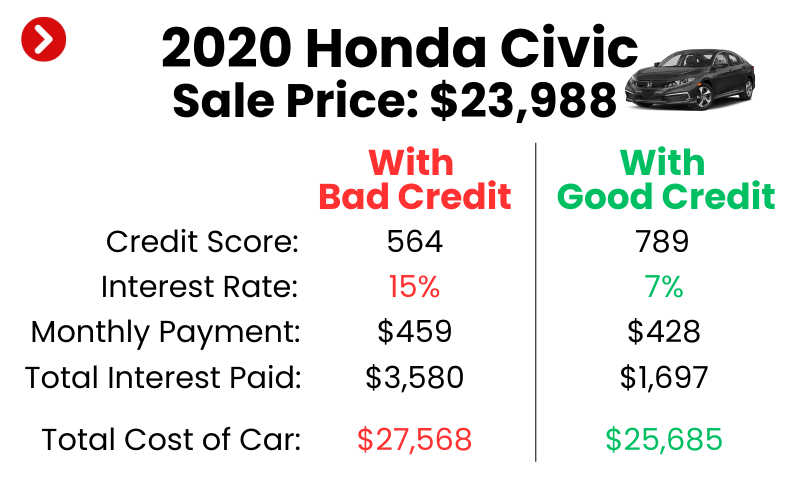

Picture this: you’re eyeing your dream car, and the dealership offers you a financing deal. But hold on, there’s a catch—the interest rate is quite high. Your credit score plays a significant role in determining the interest rate you’re offered. Higher credit scores often lead to lower interest rates, which means you’ll pay less in the long run. On the other hand, a lower score might result in higher interest rates, increasing the overall cost of the loan.

Credit Score Tiers

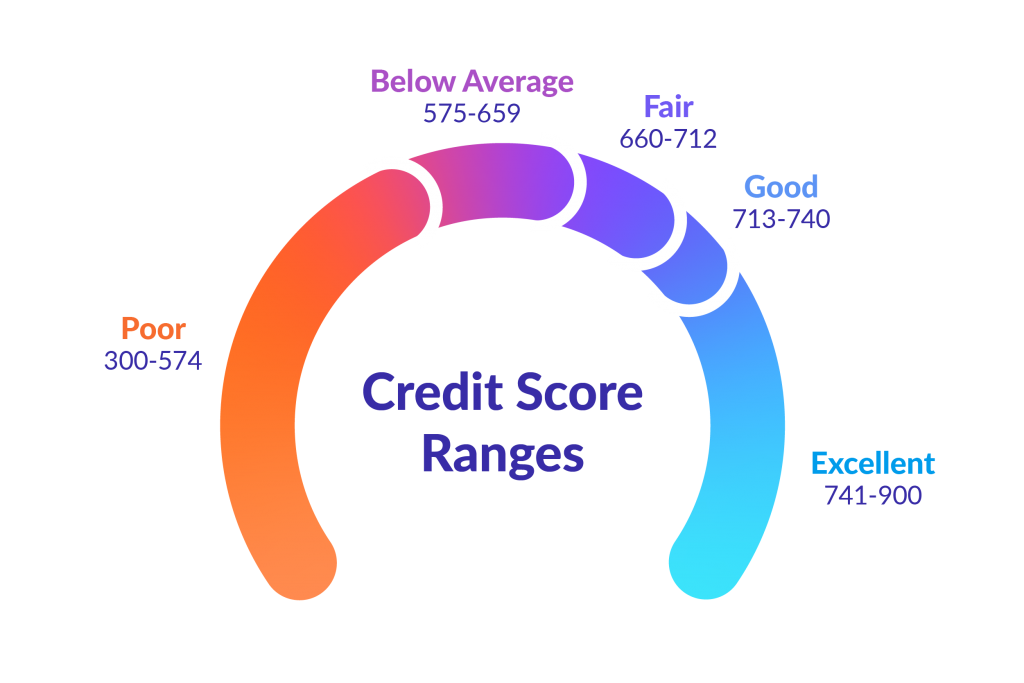

Credit scores fall into different tiers, each corresponding to a certain level of creditworthiness. While the exact ranges might vary slightly, a general breakdown looks like this:

- Excellent (750-850): Lenders view you as highly reliable, leading to lower interest rates.

- Good (700-749): You’re still a favorable borrower, though rates might be slightly higher.

- Fair (650-699): Lenders might extend financing, but interest rates could be less favorable.

- Poor (300-649): Securing financing becomes more challenging, and interest rates may be steep.

Down Payment Dynamics

The credit score doesn’t only influence interest rates. It also has a role to play in determining the down payment amount. A higher credit score might allow you to put down a smaller initial payment, while a lower score might require a more substantial down payment to mitigate the lender’s risk.

Loan Approval or Denial

Imagine walking into a dealership, excited about finally owning a car, only to find out that your loan application has been denied. It’s a scenario that can be both disappointing and frustrating. Your credit score serves as a key player in the loan approval process. A lower score might lead to rejection, whereas a higher score significantly increases the likelihood of approval.

Improving Your Credit Score

But what if your credit score isn’t where you want it to be? The good news is that credit scores aren’t set in stone. There are steps you can take to improve your score over time. Paying bills on time, reducing credit card balances, and minimizing new credit applications are all actions that can positively impact your creditworthiness.

The Credit Score’s Roadmap

In the intricate world of financing a car, your credit score serves as a guiding star. It shapes not only the interest rates and down payments but also influences whether you’re granted the loan in the first place. Understanding your credit score and taking steps to improve it can significantly enhance your chances of driving off in the car of your dreams. So, next time you consider financing a car, remember that your credit score is the key that can open the doors to your automotive aspirations.